Contents:

- Vertical Analysis Formula

- Vertical (common-size) analysis of financial statements – explanation, example | Accounting For Management

- Vertical Company Financial Statement Analysis

- Advantages and disadvantages of vertical analysis

- How to Interpret the Vertical Analysis of a Balance Sheet and Income Statement

If they were only expecting a 20% increase, they may need to explore this line item further to determine what caused this difference and how to correct it going forward. It could possibly be that they are extending credit to customers more readily than anticipated or not collecting as rapidly on outstanding accounts receivable. The company will need to further examine this difference before deciding on a course of action. Another method of analysis MT might consider before making a decision is vertical analysis. ABC Company’s income statement and vertical analysis demonstrate the value of using common-sized financial statements to better understand the composition of a financial statement.

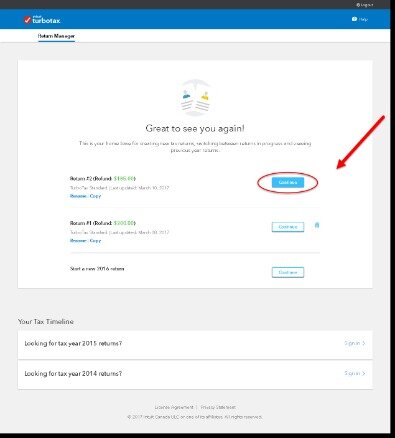

The following examples demonstrate how to do a vertical analysis using these free balance sheet template and income statement template. The calculations are performed in Google Sheets, but you can easily do the same in Excel. A Horizontal Analysis allows you to analyze financial statements to identify historical trends.

Vertical Analysis Formula

Tammy teaches business courses at the post-secondary and secondary level and has a master’s of business administration in finance. The dollar change is found by taking the dollar amount in the base year and subtracting that from the year of analysis. To calculate 2014, we DO NOT go back to the baseline to do the calculations; instead, 2013 becomes the new baseline so that we can see percentage growth from year-to-year.

Let us assume that variable expenses on year 1, 2, and 3 were $151, $147, and $142 respectively. Suppose we’ve been tasked with performing vertical analysis on a company’s financial performance in its latest fiscal year, 2021. The standard base figures for the income statement and balance sheet are as follows. In this second example, I will be doing a vertical analysis of Company B’s current assets based on its annual balance sheet.

If expenses increased by 30% year-on-year as a percent of sales, from 10% to 13%, this may be the result of any number of factors. The vertical analysis only reveals that this happened, it doesn’t provide a meaningful explanation for why it happened. For different financial statements, the base amount will be different. This means Mistborn Trading saw an increase of $20,000 in revenue in the current year as compared to the prior year, which was a 20% increase. The same dollar change and percentage change calculations would be used for the income statement line items as well as the balance sheet line items. The figure below shows the complete horizontal analysis of the income statement and balance sheet for Mistborn Trading.

Vertical (common-size) analysis of financial statements – explanation, example | Accounting For Management

This implies that the new money invested in marketing was not as effective in driving sales growth as in prior years. Ultimately, the way in which you apply a vertical analysis of your accounts to your business will depend on your organisational goals and targets. Financial Statements often contain current data and the data of a previous period. This way, the reader of the financial statement can compare to see where there was change, either up or down. Without analysis, a business owner may make mistakes understanding the firm’s financial condition.

If a company’s net sales were $1,000,000 they will be presented as 100% ($1,000,000 divided by $1,000,000). If the cost of goods sold amount is $780,000 it will be presented as 78% ($780,000 divided by sales of $1,000,000). If interest expense is $50,000 it will be presented as 5% ($50,000 divided by $1,000,000). The restated amounts result in a common-size income statement, since it can be compared to the income statement of a competitor of any size or to the industry’s percentages. First, we should review the income statements as they’re presented in dollar terms.

Another advantage of vertical analysis is that it allows you to compare financial statements from different periods or from different companies. By expressing each item as a percentage of the same base figure, you can easily compare the relative sizes of different line items between different companies or different time periods. This makes it easier to spot trends in financial performance between periods or between companies. Vertical analysis is an important financial tool that can be used to analyze the performance of a company over time. With increased visibility into a company’s finances, vertical analysis can be an invaluable resource when making key decisions about strategic planning and operations management. Ross’s Lipstick Company’s long-term debt agreements make certain demands on the business.

It would be ineffective to use actual dollar amounts while analyzing entire industries. Common-size percentages solve such a problem and facilitate industry comparison. Vertical analysis makes it much easier to compare the financial statements of one company with another, and across industries. This is because one can see the relative proportions of account balances. Other businesses use vertical analysis over several accounting periods to detect trends or variances.

Common Size Balance Sheet: Definition, Formula, Example – Investopedia

Common Size Balance Sheet: Definition, Formula, Example.

Posted: Thu, 25 Aug 2022 07:00:00 GMT [source]

But we’ll utilize the latter here, as that tends to be the more prevalent approach taken. Tools like Google Sheets or Excel allow you to automate calculations, so you can focus on analysis. Using Layer, you can also automate data flows and user management, gathering and updating the data automatically, carrying out the analysis, and sending out customized reports. With the previous year’s statement and analyzing the period’s profit or loss. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Vertical Company Financial Statement Analysis

Vertical analysis is exceptionally useful while charting a regression analysis or a ratio trend analysis. It enables the accountant to see relative changes in company accounts over a given period of time. The analysis is especially convenient to do so on a comparative basis. Income statement, every line item is stated in terms of the percentage of gross sales. This shows that the amount of cash at the end of 2018 is 141% of the amount it was at the end of 2014.

In this article, you will learn about the vertical analysis of financial statements and how to incorporate it into your company’s accounting practices. You will also learn how to carry out vertical analysis using both an income statement and a balance sheet. Financial statements that include vertical analysis clearly show line item percentages in a separate column.

Balance sheet analysis and farming performance, England 2021/22 … – GOV.UK

Balance sheet analysis and farming performance, England 2021/22 ….

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

Therefore, line items on an income statement can be listed as a percentage of the business’s gross sales. While line items on a company’s balance sheet can be listed as a percentage of total assets or liabilities. Vertical analysis is a method of financial statement analysis that focuses on the relative size of each line item within a financial statement. It expresses each item as a percentage of a base figure, usually total assets or total liabilities. This type of analysis is used to compare financial statements from different periods, or to compare different companies’ statements. It is a useful tool for investors, analysts, and financial professionals in order to measure the performance of a company.

Vertical analysis refers to the comparative analysis of the financial statement in which each line item is represented as a percentage of the base item. The items on the income statement are presented as a percentage of total revenue, and the items on the balance sheet are presented as a percentage of total assets or total liabilities. The vertical analysis of the cash flow statement is made by showing each cash outflow and inflow as a percentage of the total cash inflows.

Advantages and disadvantages of vertical analysis

If the company had an expected cash balance of 40% of total assets, they would be exceeding expectations. The figure below shows the common-size calculations on the comparative income statements and comparative balance sheets for Mistborn Trading. The highlighted part of the figure shows the number used as the base to create the common-sizing. When performing vertical analysis each of the primary statements that make up the financial statements is typically viewed exclusive of the other.

We can’t know for sure without hearing from the company’s management, but with this vertical analysis we can clearly and quickly see that ABC Company’s cost of goods sold and gross profits are a big issue. By doing this, we’ll build a new income statement that shows each account as a percentage of the sales for that year. As an example, in year one we’ll divide the company’s “Salaries” expense, $95,000 by its sales for that year, $400,000. That result, 24%, will appear on the vertical analysis table beside Salaries for year one.

Remember, on a balance sheet, your base number is always your total assets and total liabilities, and equity. Typically used for a single accounting period, vertical analysis is extremely useful for spotting trends. Though a useful tool on its own, vertical analysis can be a more useful tool when used in conjunction with horizontal analysis.

Analysis: Nucor makes another vertical investment – Recycling Today

Analysis: Nucor makes another vertical investment.

Posted: Thu, 23 Feb 2023 08:00:00 GMT [source]

This article method is one of the easiest methods of analyzing the financial statement. This method is easy to compare with the previous reports and easy to prepare. But this method is not useful to make firm decisions, and the measurement of the company value cannot be defined.

This can help a business to know how much of one item is contributing to overall operations. For example, a business may want to know how much inventory contributes to total assets. They can then use this information to make business decisions such as preparing the budget, cutting costs, increasing revenues, or investments in property plant or equipment.

It is called a vertical analysis because you analyze the percentage numbers in a vertical fashion. Explain how does the balance sheet related to the income statement. In a vertical analysis, what is used as the base on the balance sheet base amount and what is…

- Vertical analysis can be particularly helpful if looking to determine cash and accounts receivable balances over several accounting periods.

- We accept payments via credit card, wire transfer, Western Union, and bank loan.

- In this FAQ we will discuss what vertical analysis is, how it relates to horizontal analysis, and provide a simple example of how to apply it.

- Columns and show the absolute and percentage increase or decrease in each item from 2009 to 2010.

- Liquidity is a company’s ability to pay off its debts when they come due or even if they come due early.

In our sample unearned revenue, we want to determine the percentage or portion a line item is of the entire category. For example, although interest expense from one year to the next may have increased 100 percent, this might not need further investigation; because the dollar amount of increase is only $1,000. By identifying a problem, businesses can then devise a strategy to cope with it. The key to analysis is to identify potential problems provide the necessary data to legitimize change. Vertical Analysis – compares the relationship between a single item on the Financial Statements to the total transactions within one given period. Besides analyzing the past performance, analysis helps determine the strategy of a company moving forward.

- This fact indicates that the company will be able to pay its debts as they come due.

- This statement reveals the firm’s level of profitability during a specific time period.

- It also shows how a vertical analysis can be very effective in understanding key trends over time.

- Income statement, every line item is stated in terms of the percentage of gross sales.

- When using this alongside horizontal analysis, you can get a full picture of a company’s financial position.

Then review Columns and , which show the horizontal analysis that would be performed on the comparative balance sheets. The following example shows ABC Company’s income statement over a three-year period. We’ll use this as the starting point to do a vertical analysis.

SEO Teknikleri Türkiye'nin En Güncel SEO Platformu

SEO Teknikleri Türkiye'nin En Güncel SEO Platformu